Botanical

Benefits

NEW PRODUCT

trends

Scouting the next ingredient trend to sprout up in new foods and drinks? The supplement market shows health-conscious consumers are learning more about botanical ingredients—and leaning toward them in new supplement purchases.

This is particularly true in the US market, where overall supplement use is traditionally relatively high. And today, in the wake of a COVID-19 pandemic, consumers’ heightened awareness is reaching new levels. In particular, it’s important that botanical ingredients are linked to immune support in addition to other potential positive physical, mental and emotional attributes.

It is the ongoing anxiety from COVID-19 that pushed consumers toward prioritizing immune health. In fact, Innova Market Insights included “In Tune with Immune” as one of its Top Ten Trends for 2021.

Innova Market Insights research indicates that 54% of global consumers claimed to have spent time educating themselves on ingredients and procedures that could boost their immune health in the wake of COVID-19. Consumers were asked which elements would be most important to achieve immune health. In order, the top leading responses were “getting enough sleep,” “being healthy physically” and “choosing foods naturally high in nutrients (vitamins, minerals, antioxidants).” There is an associated increase in interest in botanical ingredients, in particular.

By LU ANN WILLIAMS, Contributing Editor

Botanical ingredients flourish; add function and appeal to new foods and drinks.

Photo courtesy of: Getty images / jchizhe

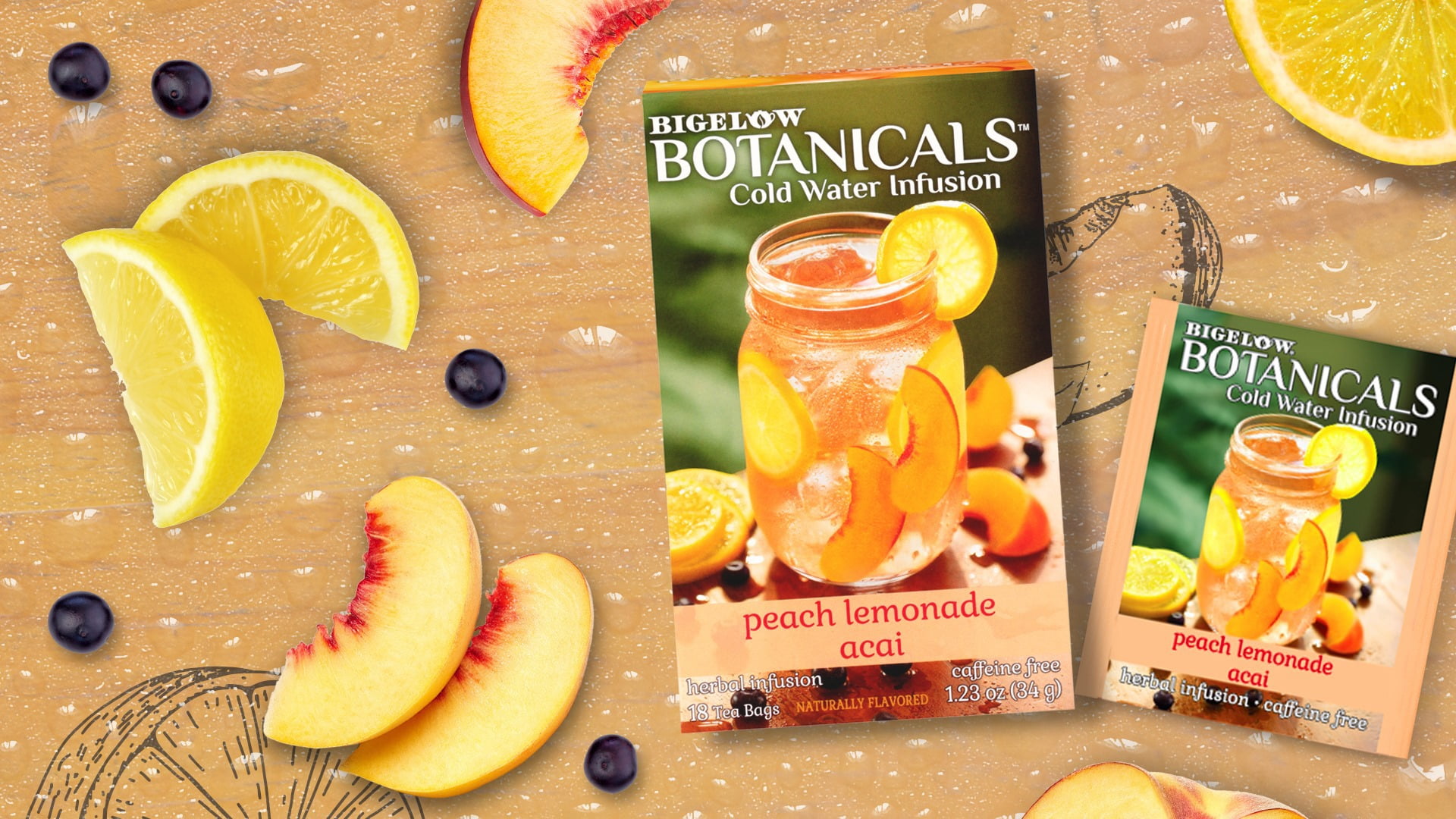

Want botanical benefits? Just add water. Consumers can create their own botanical infused water by simply infusing each tea bag in cold water for 8 minutes or leaving it in longer for more flavor. Photo courtesy of: R.C. Bigelow Inc.

Supplements remain the main approach for maintaining immune health, and these are using a wide range of botanical ingredients such as turmeric, echinacea, elderberry and mushrooms, in addition to more standard vitamins and minerals.

According to Innova Market Insights data, botanical/herbal supplements lead the US supplements market in terms of new product development—having now overtaken vitamins/minerals, the long term leader. Botanicals accounted for more than 29% of US supplements launches recorded in 2020, compared with just under 25% for vitamins/minerals. In the meantime, there also is rising interest in the use of botanical ingredients in the mainstream food and drinks markets, particularly in beverages.

There are growing numbers of new foods and beverages with immune benefit claims. This is particularly true in beverages, which are viewed as good carriers for functional ingredients.

Last year’s new immune support offerings included Bolthouse Farms’ Superfood Immunity Boost (with elderberries, cranberries, echinacea and zinc); Suja Juice’s Immunity Defense Shot with Turmeric & Probiotics (also contains echinacea); Bigelow Benefits Lemon & Echinacea Herbal Tea; and Tea Forté Defense green tea (with echinacea, ginger and elderberry).

Adaptogens Ascending

Even prior to this accelerated interest in immunity, botanicals benefited from rising awareness of the health benefits associated with adaptogens.

Adaptogens have emerged as a class of herbal extracts with claims to boost the body’s ability to combat physical, chemical and biological stresses—as well as elevate cognitive functions, mood and energy levels. They are most commonly associated within traditional Ayurvedic and Chinese medicinal practices. The main focus is in supplements to date, but activity here also is starting to move into the health-driven food and beverage space.

With greater overall interest, consumers are learning more about botanicals such as ashwagandha, schisandra, ginseng, rhodiola and moringa. It’s also claimed that some adaptogens can be combined to amplify their benefits. For example, one product that blends ashwagandha, rhodiola and schisandra could have greater overall benefits than a product with any one of these used alone.

Company infuses sparkling water with a blend of dry hops for a citrus-forward, IPA flavor—without the alcohol. HopWTR when adds L-Theanine and ashwagandha for “stress-busting” benefits to “deliver the chill you crave, without the hangover.” Photo courtesy of: HOP WTR Inc.

Some relatively unfamiliar ingredients with low awareness are starting to appear in new product claims. One of these certainly is ashwagandha, an adaptogen associated with reducing stress and anxiety. Interestingly, products with ashwagandha still are most likely to be carrying claims related to energy and alertness. Innova Market Insights data show ashwagandha claims rising sharply from a low base, accelerating further in 2019 and 2020, with supplements and sports nutrition as the leading applications.

The US markets leads in the commercial application of ashwagandha in food and beverage launches. In fact, Innova Market Insights reports that the number of food and beverage launches tracked in the US is three times higher than those reported in India, ashwagandha’s country of origin. In 2020, supplements dominated use for new product development. Sports nutrition ranked at a distant second place, with a particular focus on sports powders. There was also growing interest in the more mainstream beverages categories, although from a small base. These include soft drinks, hot drinks and even some alcoholic beverages.

Plant-powered protein bars include ashwagandha, cordyceps for anxiety relief. Photo courtesy of: Feed Your Brain Inc. / Mindright

Moment of Calm LLC, New York, N.Y., introduced Moment Rooibos Orange Botanical Water featuring ashwagandha and L-theanine. Elements LLC, Bryn Mawr, Pa., introduced an Elements by Lokai Sleep Functional Wellness Drink with Adaptogens. It features ashwagandha and L-theanine but is presented more as a sleeping aid.

Other recent soft drinks launches featuring ashwagandha include Hop Wtr sparkling hop water with adaptogens and nootropics (HOP WTR Inc., Los Angeles); and Pep in Ya Step Wellness Shot from Happy Moose Juice Inc., San Francisco. This cold pressed wellness shot highlights ashwagandha’s role in promoting “a natural boost of vitality and energy.”

Hot beverage activity mostly involves herbal teas and infusions. Teeccino Caffé, Inc., Carpinteria, Calif., introduced Teeccino Organic Mushroom Herbal Tea with Chaga (Siberian wild mushroom) and Ashwagandha and prebiotic inulin. Last year also saw Twinings North America Inc., Clifton, N.J., launch Twinings Calm Adaptogens Fig & Vanilla tea with ashwagandha, which “promotes a balanced mood.”

According to Innova Market Insights data, botanical/herbal supplements lead the US supplements market in terms of new product development, having now overtaken vitamins/minerals, the long term leader … [T]here also is rising interest in the use of botanical ingredients in the mainstream food and drinks markets, particularly in beverages.

Botanicals also serve natural energy boosts. In supplements, they’re incorporated to provide energy and potentially promote endurance, stamina and overall strength. As a result, this demand encompasses natural caffeine sources such as mate and guarana; as well as adaptogens such as ginseng, schisandra, rhodiola and cordyceps.

Boston Iced Tea Co., Sausalito, Calif., incorporates cordyceps in a proprietary mushroom blend used in its organic RTD line. It offers African Black Tea, Kenya Green Tea, Imperial White Tea and Caffeine-free Rooibos Red Tea. Officials say the teas are formulated to “energize the body, focus the mind and strengthen the immune system.” This spring saw Califia Farms, Los Angeles, introduce Mushroom Oat Barista Blend with cordyceps and Lion’s Mane, another mushroom long used in traditional Chinese medicine.

Mood Boosts

There’s also rapid growth involving new products that target “mood” and botanical extracts and adaptogens are key ingredients here too. “Mood: The Next Occasion,” was another one of Innova Market Insights’ Top Ten Trends for 2021. It highlights the growing importance of mental and emotional wellbeing as consumers they take a more holistic approach.

There is rising use of on-pack claims related to specific mood platforms. Calming/relaxing and energy boosting are the most established platforms in mood health. Sleep is still a niche positioning, but is quickly growing from a smaller base and showing potential for further innovation.

Bottom’s Up Before Bed. Some beverages leverage adaptogens for sleep benefits. Photo courtesy of: Elements LLC

Interestingly, more consumers interested in brain and cognitive health appear to be favoring new functional foods and beverages and switching away from traditional supplements. Since 2019, Innova Market Insights has registered a sharp increase in those new foods and drinks making brain health claims. In addition to traditional options such as omega-3 fatty acids and choline, a growing number of brain health claims are referencing botanical ingredients, nootropics and adaptogens.

There has been particular interest in sleep and relaxation benefits, no doubt boosted by the COVID-19 pandemic. Stress, anxiety and sleep quality are closely linked and, although recent initiatives have been led by supplements, there also is growing interest in the wider food and drinks market. Herbal ingredients are probably the best known in the sleep space. These include valerian, lemon balm, lavender and chamomile, which have long been associated with traditional medicine. There also are basic nutrients such as magnesium and vitamins, plus other ingredients, such as L-theanine.

This year brought an interesting US launch of Verywell, a hemp-derived, adaptogenic, sparkling CBD water from Truss CBD USA (Molson Coors) The Unwind Blueberry Lavender Sparkling CBD Water contains L-theanine, as well as ashwagandha and CBD/hemp extract. Two other products Verywell varieties also had mood/brain health positionings: Mind & Body Strawberry Hibiscus and Focus Grapefruit Tarragon. Both also feature CBD/hemp extract and adaptogens.

While the primary initial focus of adaptogens involved mood and energy, there’s also growing interest from the beauty market. Here, botanical extracts such as moringa, turmeric, aloe vera and acerola are lauded for helping regulate body processes that support healthy skin the elements it needs to optimize appearance (and overall health).

This is likely to develop further as the food and beverage market sees a growing number of launches that border on the cosmeceutical. Consumers are increasingly consuming food and drinks that support their physical appearance and reduce the effects of ageing, focusing on beauty-enhancing ingredients for the benefit of body, nails, hair and skin, including the use of herbal and botanical extracts alongside the development of more traditional ingredients such as collagen.

Launch activity has mainly been focused on supplements to date, but like other activity is starting to move into the mainstream food and drinks market, particularly initially for beverages offering a range of health and wellness benefits.

Interest in botanical ingredients, particularly adaptogens, in supplements, food and beverages is only likely to develop further in the face of the increasingly holistic approach to health being taken by consumers as they look to optimize their physical and emotional wellbeing. PF

Lu Ann Williams is Global Insights Director at Innova Market Insights, provider of market research services including the Innova Database. With more than 25 years’ experience in the food industry, Lu Ann is a trend expert and frequent public speaker at events worldwide. She leads a team of analysts and works with global clients. Contact her at luann.williams@innovami.com

July 2021