Plant Based Foods, Part 1

Trends

By LU ANN WILLIAMS, Contributing Editor

Plant protein innovation expands options, opportunities.

Protein’s Progress

Innova Market Insights first looked at “plant-based” five years ago, back in 2018. That’s when the term started to go global after originating in the US and Europe. Interestingly, the “plant based” trend wasn’t involving basic fruits and vegetables. Rather, the term referred to alternative dairy products and then expanded to encompass meat alternatives, main dishes, spreads, and numerous other subcategories.

Although plant-based has become a popular term in the dairy- and meat-free categories, it does not accurately describe all developments in this fast-moving field. There are technologies that generate “animal-free,” bioidentical ingredients such as dairy whey and dairy casein. Even so, “plant-based” continues to grow in use, with indexed average annual growth of +42% between 2017 and 2022.

Let’s take a look at consumer attitudes around plant-based claims and ingredients. We’ll also explore trends in classic and emerging plant proteins and technology-driven activity in animal-free protein ingredient development.

Photo courtesy of: Getty Images / ArtMarie

Protein continues to be the top “hero” nutrient, including in plant-based products. High-protein claims as a percentage of launches with plant protein ingredients are up five percentage points during a five-year period.

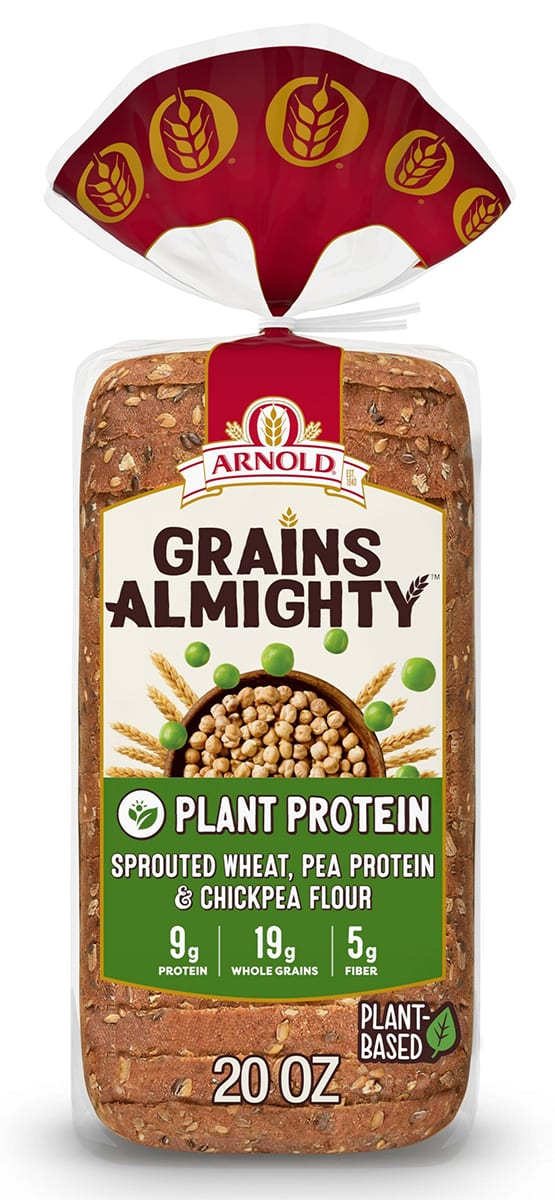

Bimbo Bakeries’ Arnold, Brownberry and Oroweat brands introduced two better-for-you varieties: Grains Almighty Gut Balance and Grains Almighty Plant Protein. Baked with sprouted whole grains, chickpea flour and pea protein, Grains Almighty Plant Protein Bread has 9g of protein, 19g of whole grains and 5g of fiber in every two-slice serving. Photo courtesy of Bimbo Bakeries USA

Consumers Want Protein

Consumers globally continue to be extremely interested in protein and this gives the nutrient an outsized reputation. In a recent Innova Market Insights survey, nearly one in six consumers said they changed to a high-protein diet in the past year. Meanwhile, an overwhelming five in six are interested in consuming protein in their food and beverage products.

Our surveys dug deeper into consumer motivations and behaviors involving protein foods. Nearly half of those participating in our 2023 Trends Survey reported following diets that involve reduction or removal of meat and/or dairy. Those responses were up from 43% in 2022. When we asked about the rationale behind cutting back on meat and dairy consumption, consumers named health and price. Interestingly, they identified protein and digestive health as important reasons for consuming meat and dairy alternatives. They also said they regard plant-based alternatives as better for the planet.

Survey respondents told us they would like plant-based products to have better flavor and texture, feature regional flavors, and stand on their own without mimicking meat or dairy. About one-quarter of U.S. consumers surveyed said the market could use even more plant-based milk and meat alternatives.

When asked about new technologies for meat and dairy alternatives, consumers expressed similar levels of excitement or curiosity about most technologies presented in the survey. They had slightly lower levels of interest in the creation of meat in the laboratory or through 3D-printing technology. They were more welcoming of meat alternatives produced with fungi or microalgae. In the dairy arena, recognized technologies such as fermentation and pasteurization drew most interest, but many also are willing to accept processors’ use of bacteria, algae, enzymes and fungi.

Eat Just Inc. said its GOOD Meat brand sold its first charcoal-grilled cultivated (cell-based) chicken this past summer at Chef José Andrés’ China Chilcano restaurant in Washington, D.C. Officials said the landmark dinner honored the late Willem van Eelen, widely known as the “godfather of cultivated meat” and would have celebrated his 100th birthday on July 4, 2023. Photo courtesy of GOOD Meat / Eat Just Inc.

Name It. Claim It.

Protein continues to be the top “hero” nutrient, including in plant-based products. High-protein claims as a percentage of launches with plant protein ingredients are up five percentage points during a five-year period. Protein claims appear on more than one-quarter of products with plant or non-animal protein ingredients. This represents an increase from one-fifth of plant protein launches in 2017-2018, and are much more prevalent on products with plant or non-animal protein ingredients than on general launches.

After protein, claims related to gluten-free, fiber, and lactose-free are prominent (and also continue to grow) on products with plant or non-animal protein ingredients. End of Part 1

Lu Ann Williams is global insights director at Innova Market Insights, provider of market research services including the Innova Database. With more than 25 years’ experience in the food industry, Lu Ann is a trend expert and frequent public speaker at events worldwide. She leads a team of analysts and works with global clients. Contact her at luann.williams@innovami.com