sports Performance/Recovery Products

TRENDS

Market—

Sports, recovery foods and beverages grow, add broader appeal.

With Muscle

By Erin Costello

By Lu Ann Williams

Credit: Extreme Media / Getty Images

Once the domain of athletes, sports products now appeal to a wide range of consumers and have become ubiquitous in the US marketplace.

Not long ago, sports and recovery products were sold mainly by gyms and specialty stores with a target audience of serious athletes and body builders. Today, these products occupy shelf space across the retail landscape and capture the attention of not only serious sports enthusiasts but also casual active participants and regular consumers simply looking for a boost.

Energy, hydration, and protein are central to sports and recovery products and these attributes are increasingly attractive in the wider market. Consumers want energy to help fuel activities at any level. Hydration is a major focus throughout the US beverage industry. Last but not least, protein products are gaining significant traction in sports nutrition for muscle building and repair. More broadly however, consumers are gravitating to higher protein levels as part of a healthier diet.

Next Wave Options: New lightly carbonated protein drinks deliver 25g of protein, 0g of sugar, and only 100 calories per can as an alternative to traditional protein shakes. Bucked Up Protein Drinks were named “Best Innovation” at the Arnold Sports Festival in late February. Credit: DAS Labs LLC

On Trend Innovation

Not surprisingly, several of Innova Market Insights’ Top 10 Trends align with sports nutrition. In fact, three of the 2025 Top 10 Trends are particularly relevant.

Our top 2025 trend, “Ingredients and Beyond,” highlights the importance of adding value to products—beyond the ingredient list. Consumers name quality as the most important product feature that connotes value. And they recognize value in private label and store brand products, including those for sports and recovery, that are priced competitively, readily accessible, varied, healthy, and high quality.

Our #2 trend for 2025, “Precision Wellness,” describes the consumer search for products to meet their personalized nutrition needs. Performance nutrition is a priority; the addition of key nutrients to sports products allows consumers to select products for their particular concerns.

The ninth trend for 2025, “Mood Food: Mindful Choices,” demonstrates consumer prioritization of mental and emotional wellbeing. Increasingly, we see sports nutrition product launches with mood and focus benefits.

Remember to Recover! Hydration becomes more popular for athletes and non-athletes alike. Recover 180 features organic coconut water, essential vitamins and minerals. Credit: Recovery Sports LLC

Consumer Seek Positive Nutrition

Consumers look for products that boost nutrition intake and improve how their body functions—both for day-to-day and during physical activity. Sports nutrition aims to meet consumer needs with products that are both healthier and functional—with functionality focused on both performance and recovery.

Manufacturers are taking new product development beyond core sports nutrition functionalities into added value through complementary health benefits, additional health claims around sugar reduction, and plant-based ingredients.

Several product features are common to sports nutrition. Protein is a perfect fit for the health-conscious sports enthusiast who views protein as essential to health. Plant-based is another feature that appeals to consumers seeking products for sports and recovery. Some of the interest in plant-based is driven by consumers who are vegetarian- or vegan-curious or committed, while others are attracted to a more plant-based diet. Manufacturers are responding, as evidenced by the rise in the number of vegan product launches.

Consumers also seek sports and recovery products fortified with vitamins and minerals. These also are promoted to optimize performance and well-being.

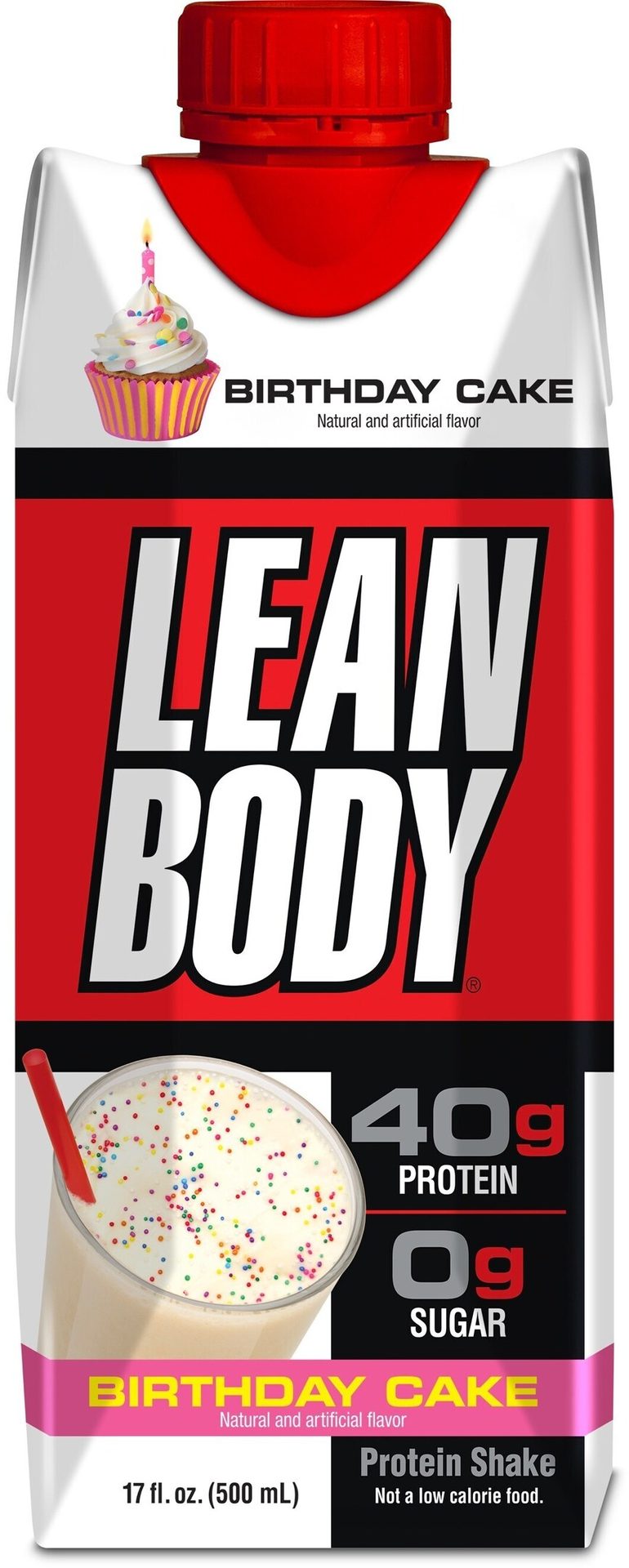

Let Them Eat Cake! New workout offerings target high protein (40g) with fun flavors. Credit: Labrada Nutrition Inc.

Trends in Sports and Energy Drinks

The US leads consumption globally in both energy drinks and sports and recovery beverages, with about one-third of the global market for each. Ready-to-drink sports products account for about one-third of total US retail sales of energy drinks. Both energy and sports/recovery drinks show strong compound annual growth.

Consumer insights research suggests taste and flavor are the most important factors for consumers of sports nutrition products. Brand and convenience are less influential. Interestingly, when it comes to flavor, the sports nutrition marketplace offers a little bit of everything—including bold, unique and fun nostalgic flavors. These include Strawberry-Kiwi to the rapidly emerging Black Cherry and Dragon Fruit to Punch, Passion Fruit, and Green Apple.

Energy drinks are the most established and widely purchased functional beverage in the US. They appeal to consumers to provide energy, boost alertness, and supply added vitamins and minerals. We project continued volume growth in energy drinks during the next several years.

On-the-Go Energy. Organic energy option for athletes and active, everyday enthusiasts. Credit: EN-R-G Foods, LLC

Sports drinks offer benefits for performance, bodybuilding, pre/post workout, and overall wellness. Innova observed a major drop in sports nutrition launches during 2020 and 2021 at the height of the COVID pandemic. Consumer participation in athletic activities changed and consumption of sports nutrition products went down. Today, innovation is on the rise at a faster rate than for functional beverages overall.

Global giants PepsiCo, Danone, and Coca-Cola lead the US marketplace for sports and energy drinks. However, the market is highly fragmented, with the top 10 innovators representing just 15% of national launches. Well-established smaller companies in the marketplace include Monster Beverage Corp., Celsius Holdings Inc., and Red Bull GmbH.

What’s on the Label

We see tremendous overlap between sports nutrition products and health features. Beverages with energy claims often include hydration benefits that increase water absorption and replenish electrolytes. Immune health, brain health, and prebiotic claims are on the rise. Ingredients such as the minerals zinc, potassium, and magnesium, along with beta-alanine, L-carnitine, Lion’s Mane and other adaptogenic mushrooms and other rapidly growing functional ingredients confer additional health benefits.

Nostalgic Nod: Processors boost appeal with familiar flavors. Credit: BellRing Brands, Inc.

Powders with Star Power. Powders remain popular. MLB star Bryce Harper endorses new NSF Certified for Sport® protein powders, electrolytes, and pre-workout powders—formulated specifically for athletes. Credit: Just Ingredients

For example, certain vitamins and minerals are associated with quick recovery. Not surprisingly, the addition of protein and amino acids is on the rise for general and specific health, performance, and recovery benefits. Consumers demand has grown for gluten-free sports and recovery products and manufacturers have responded by increasing sports nutrition launches that are gluten-free. For some consumers, a gluten-free claim also confers healthfulness.

Several ingredients and product features are trending. Green tea extract (EGCG) is promoted to aid weight loss by boosting metabolism, burning body fat, and increasing energy. Caffeine and caffeine sources such as green coffee beans and cascara fruit also are associated with energy. L-theanine commonly is added to ready-to-drink sports, protein, and energy drinks to help manage stress and offset the effects of caffeine. Alpha-GPC is on the rise for brain health.

Ingredients for beauty and longevity – glycerol, collagen, sea minerals, vitamins, ingredients positioned to target aging – often are added to sports nutrition products to support athletic performance, appearance of skin and hair, bone and joint health, and personal well-being.

Powdered Supplements are Popular

Powdered supplements are a major sports nutrition category, especially in Canada. According to a recent consumer research study conducted by Innova, more than two-thirds of Canadian consumers using sports nutrition products use powdered versions of supplements. Consumers consider powdered supplements to be convenient, easy to use, and compatible with an on-the-go lifestyle.

Functional product features can include creatine for muscle health, whey protein, casein protein, electrolytes for balance and repletion, essential amino acids (EAAs), and branched-chain amino acids (BCAAs). Ingredients may be added alone or in combination to improve fitness and boost athletic performance.

Greater Focus on Recovery

Consumers are becoming more aware of the importance and benefits of recovery, and the need for nutrients and products to optimize muscle recovery and promote overall well-being. Products to support recovery can include a wide range of ingredients such as protein powders, EAAs, BCAAs, glutamine, creatine, and testosterone boosters.

From Football to Food: 3X Super Bowl Champion Ed McCaffrey expands namesake food line with new protein bites that are gluten-free, plant-based, and non-GMO. Credit: McCaffrey Brands

We are monitoring the emergence and rise of sports and recovery products with functional ingredients to support mental health, which is a growing area of focus for consumers. In fact, one-quarter of US consumers name brain health as a primary concern. Trending brain health ingredients include citicoline, huperzine, L-theanine, and acetyl-L-carnitine. These are gaining traction with formulators for their support of cognitive function and mental clarity. This trend demonstrates the growing understanding in the industry and among consumers of the interconnectedness of physical and mental well-being.

Prebiotics fibers add value to sports and recovery products—especially functional beverages—through claims related to gut health, immune health, and blood sugar balance.

In closing, we anticipate continued growth in sports and recovery products—particularly in functional beverages that bridge performance and personal health and wellness. Natural caffeine sources, functional mushrooms, ingredients for mental performance, ingredients to boost appearance, and vitamins and minerals associated with hydration increasingly will be standard in sports and recovery products.

General trends such as sparking beverages, sugar reduction, and gut health ingredients can spill over into sports nutrition. Seasonal and limited edition releases bring excitement and invite trial during periods of limited availability. Collaborations between sports nutrition brands and established food and beverage companies will blur the lines among sports, functional, and conventional products.

Lu Ann Williams is Global Insights Director at Innova Market Insights, provider of market research services including the Innova Database. With more than 25 years’ experience in the food industry, Lu Ann is a trend expert and frequent public speaker at events worldwide. She leads a team of analysts and works with global clients. Contact her at luann.williams@innovami.com