dairy foods plant-based alternatives

STATE OF THE

industry

How big are plant-based dairy products? Oatmilk products producer Oatly took a second quarter Super Bowl television spot to showcase its CEO Toni Petersson. Petersson sat in an oat field, played keyboard and sang his own song, “Wow, Wow, No Cow.” Shortly afterward, Oatly Instagram followers could sign in the next day for a free t-shirt. Said Oatly: “Maybe interrupting the second quarter so the world could experience Toni's musical stylings about how oatmilk is like milk but made for humans wasn't the most Super Bowl-ish idea ever, but on the other hand, our attempt to promote Toni's singing skills to a wider audience actually got you to visit an oatmilk company website on the big day. Total success!” Photo courtesy of: Oatly

Although most of today’s new plant-based dairy alternatives are cold—displayed in the dairy case or the freezercase—they constitute one of the supermarket’s hottest and fastest growing segments. And it’s no surprise market observers are scrutinizing every element behind who’s purchasing these products—along with what’s selling, when, where and why.

For the record, market researcher Packaged Facts projects retail sales of plant-based dairy and egg products will rise at an average annual rate of 6.0%, reaching $5.2 billion by 2024. This is up from $4.3 billion in estimated sales in 2020, which itself is up from $3.9 billion in sales during 2019.

Despite potential industry disruptors such as the lingering economic impact of the coronavirus, Packaged Facts found that growth in the market for plant-based and cell-cultured dairy and egg alternatives will continue due to new product introductions and increasing availability (particularly in smaller non-milk categories); rising consumer adoption; and upward momentum of consumption of these products among those who already eat plant-based dairy or eggs.

by BOB GARRISON, Chief Editor

Plant-based dairy alternatives spring up everywhere to satisfy fast-growth market.

What’s Hot in Cold

In 2020, producers focused on investing in better technology and improving economies of scale to make plant-based dairy and eggs more affordable to general consumers. As the prices of these products decrease over the 2019-2024 forecast period and more closely approach the price of conventional dairy and egg products, volume consumption is expected to increase significantly with rising adoption among general consumers as well as higher consumption of these products among plant-based dairy and egg eaters.

Plant-based milk will account for the largest gain in sales over the forecast period, as the category is the biggest by far (estimated sales of $2.4 billion in 2020) and still has prospects for further adoption. Many plant-based milks do not imitate the dairy milk taste or texture, meaning that consumers who do not like the taste of these products compared to milk will not adopt them. However, plant-based milk products are being developed that reportedly cater to the preferences of “dairy lovers” who prefer the real dairy taste. For instance, Impossible Foods is reportedly working on Impossible Milk, which will more closely approximate the taste, texture, and function of dairy milk than other products already on the market.

Los Angeles’ Hakuna Brands recently rebranded as Must Love. It offers banana- and oat milk-based “nice” creams in flavors such as Peanut Butter Swirl and Choco Choco Chip. Photo courtesy of: Must Love

Spreads, dips, sour cream, sauces, and cheese also will experience double-digit growth going forward, as these relatively small categories have a number of product introductions and are increasing consumer adoption.

Plant-based cheese in particular has faced hurdles to consumer adoption because many available products do not sufficiently imitate the taste or texture of cheese that consumers love. Plant-based cheese is still far from taking significant share away from dairy cheese sales, which continue to grow faster than dairy sales overall. Thus, Packaged Facts predicts that plant-based cheese sales will grow faster in the 2024-2029 period than the 2019-2024 period due to better technology and processes eventually being developed that make more dairy-like plant-based cheese products. By 2029, Packaged Facts expects that plant-based cheese will come to be the second largest category in the plant-based dairy space.

Who Buys & Why?

Despite use of plant-based meat or dairy products being highest among those following vegan, vegetarian, or pescatarian diets, it’s omnivores and flexitarians who make up the lion’s share of consumers who eat these products due to their sheer numbers, said Packaged Facts in a January 2021 report: “Vegan, Vegetarian, and Flexitarian Consumers.”

“Although plant-based meat and dairy alternatives do appeal to some vegans and vegetarians, they are more targeted toward the preferences of omnivores and the more plant-focused flexitarians who are most open to replacing animal products in their diet with other foods,” says Jennifer Mapes-Christ, food and beverage publisher for Packaged Facts. “Vegans and vegetarians make up just a small portion of the population, while omnivores and flexitarians combined account for the vast majority. Thus, these large groups represent a larger potential market for plant-based meat and dairy alternatives than the vegans and vegetarians these products were first developed for decades ago.”

Packaged Facts survey data reveals that protein from plant sources is considered healthy by 69% of U.S. consumers, compared to just 42% of consumers who think animal protein is healthy. People who have recently started to be vegan or vegetarian after eating meat or dairy may find these alternatives pleasing if they miss the taste or texture of meat or dairy, whereas experienced vegans and vegetarians may not miss these products and have often adapted their diet and lifestyle around plant-based foods that look and taste like plants. Some vegans and vegetarians simply find the idea of meat or dairy repulsive and thus have no interest in products that attempt to replicate their characteristics.

Additionally, although some vegans and vegetarians may be interested in plant-based alternative products, those that have chosen their diet and lifestyle for health reasons are likely to reject many of these products because they tend to be highly processed and may have ingredients with an unhealthy perception that many consumers try to avoid, such as preservatives, soy, or gluten.

To those who are health-focused, foods that are more “pure” instead of “processed” are most appealing, meaning that alternatives that are engineered as a substitute for another product may be disregarded in favor of other foods. This is especially true of the clean label movement, which rejects foods with “unpronounceable” ingredients and looks for products that are unadulterated and wholesome.

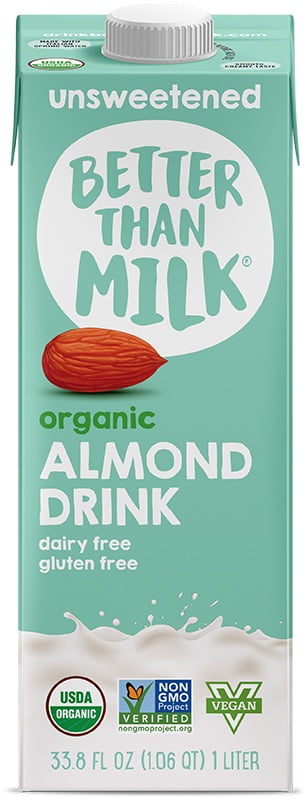

Milks represent the largest non-dairy alternative segment—and it keeps growing. One new entry is PANOS Brands, Rochelle Park, N.J., with its Better Thank Milk organic line. Five flavors include Unsweetened Almond Drink, Almond Drink, Unsweetened Oat Drink, Unsweetened Rice + Calcium Drink, and Rice Hazelnut Drink. Photo courtesy of: PANOS Brands

In addition to vegans and those who are simply trying to consume more plant-based foods, plant-based dairy alternatives also are targeted at people who have dairy allergies or are otherwise sensitive to the lactose found in conventional dairy products. Lactose intolerance is increasingly common – or at least people are more aware of it – driving people who are otherwise omnivores to plant-based “milks.”

However, plant-based alternatives to dairy in particular often contain common allergens including soy or tree nuts (e.g., almonds and cashews), meaning that people allergic to these ingredients may be unable to consume a large number of plant-based dairy products. As such, products such as coconut milk are important for consumers with allergies since coconut is not a common allergen and is not typically exposed to allergens such as soy or wheat during production.

Nonetheless, almond milk remains the best-selling dairy alternative on the market, and oat milk has become the second largest plant-based milk category (and oats are often not safe for people with celiac disease, wheat allergies, or sensitivities due to often being exposed to wheat during production).

Almond milk remains the best-selling dairy alternative on the market, and oat milk has become the second largest plant-based milk category.

Still more researchers have been curious around the “where” of product consumption. NPD Group says that when it comes to eating plant-based foods, consumers are definite in which types of these foods they want to eat at home—and which they want to eat from a restaurant or foodservice outlet.

About 93% of meals or snacks that include milk alternatives are consumed at home and 7% are at/from a restaurant or foodservice outlet. When it comes to meat analogues, restaurants and other foodservice outlets have the largest share of eating occasions at 78% while at home represents 22%, according to NPD’s Eating Patterns in America, an annual compilation of the company’s ongoing food and foodservice market research.

“Consumers eat more plant-based meat analogues from restaurants because these foods are prepared in the same way animal protein menu items are, which means the consumer isn’t sacrificing taste for what they believe to be a healthier option. It would be challenging to replicate the same taste at home,” said Darren Seifer, NPD food and beverage industry analyst. “Dairy alternatives, on the other hand, are an at home choice because these beverages and foods are convenient as a ready-to-drink beverage or to use as an ingredient.”

Although drinking dairy milk at home is still a larger behavior, consumption of dairy alternatives in home is penetrating the market at a rapid pace. Consumers are choosing to drink milk alternatives, such as almond milk, rather than dairy-based milk. Contributing factors to this growth is the health-halo plant-based foods have and the want of some consumers to cut down on dairy in their diets. Still, many consumers drink both cow’s milk and milk alternatives.

“Consumers see plant-based alternatives as healthier options to their traditional counterparts,” says Seifer. “Plant-based beverages and foods are growing and gaining loyalty. These products still represent a small share in the categories in which they compete, but do give consumers more options to consider.”

Meet the Alternatives

Perhaps not surprisingly, major dairy brands such as Chobani LLC, Norwich, N.Y., and Danone North America, White Plains, N.Y., are among those leading new product development of non-dairy alternatives.

Chobani introduced oat-based products as it closed out 2019. This line now encompasses plain and flavored milks, flavored coffee creamer and a range of yogurts, including mix-in split packs. In July 2020, it came back with Chobani Probiotic, a range of functional style, plant-based beverages. The oat and fruit juice base is fermented with a blend of probiotic cultures to support digestive and immune health. Four flavors include Lemon-Ginger, Pineapple Turmeric, Peach Mint and Cherry Hibiscus Tea.

Early 2020 saw Danone extend its popular Activia probiotic line with plant-based dairy-free yogurts made with almond milk. Its line includes such flavors as Peach Hibiscus, Raspberry Pomegranate, Blueberry Açai and Vanilla Cinnamon. Danone also launched plant-based options across its wider dairy brand portfolio. Just in yogurts alone, these new options included Dannon Light & Fit Good Plants vegan yogurts and a coconut milk version of its popular Oikos Greek yogurt.

Of course, Danone already has an established and market-leading range of plant-based yogurts in the US, with well-established brands such as Silk and So Delicious that came with the purchase of WhiteWave in 2016. In preparation for an expected run on plant-based dairy alternatives, Danone also opened North America’s largest plant-based yogurt production facility in 2019, with the goal of tripling its overall plant-based business by 2025.

While non-dairy spoonable yogurt remains a very small market globally in comparison with its dairy counterpart, it is seeing very strong growth. Its share of dairy launches rose from less than 0.5% in 2012 to 1.7% in 2019 and to 2.3% in the 12 months to the end of March 2020. This share more than doubles to over 5% in the highly developed US market, however, reflecting the strength of plant-based and dairy free alternatives in the country overall. New product development growth in North America overall has been very strong in recent years as interest has accelerated, and over the 2015 to 2019 period the CAGR of 32.6% for non-dairy spoonable yogurt far outperformed the dairy category growth figure of just under 8%.

For the record, the US also has experienced a surge of other non-dairy offerings across all categories –including butter, cheese, milk and frozen desserts. Two new plant-based milk alternatives hail from PANOS Brands LLC and Koita Foods, companies that both have ties to Italy. PANOS, Rochelle Park, N.J., introduced five organic varieties of Better Than Milk—including Unsweetened Almond Drink, Almond Drink, Unsweetened Oat Drink, Unsweetened Rice + Calcium Drink, and Rice Hazelnut Drink. Meanwhile, Koita Foods’ namesake shelf-stable line also includes six options: Organic Almond, Oat, Soy, Soy for Coffee, Rice and Organic Coconut.

Other noteworthy new plant-based milks hail from Chile’s NotCo, which launched NotMilk in Whole Foods Market stores nationwide. EVR Foods, Aiken, S.C., also branched out of plant-based yogurts and into milks with its Lavva plant-based foods brand (formulated with Pili nuts). Also extending its technology forward was Perfect Day, the Emeryville, Calif., firm that developed a non-animal whey protein. Perfect Day launched a spinoff, The Urgent Co., to introduce Brave Robot animal-free dairy ice cream. Meanwhile, Perfect Day also has partnered with others, such as Cincinnati’s Graeter’s Ice Cream, to introduce Perfect Indulgence, also an animal-free frozen dessert. PF

Editor’s note: Product portions of this article are excerpted from Innova Market Insights feature, “Brave New World,” in Prepared Foods February 2021 digital edition.

MARCH 2021