Fiber & Digestive Health

TRENDS

New Day

Bran

Fiber options, applications, embrace holistic gut health, expand to more than muffins.

Remember the bran muffin? Could it be that this classic—once so closely associated with fiber—has become an endangered species? Not that long ago, bran muffins were standard at coffee shops and bakeries as the healthy, high-fiber breakfast and snack option.

Top food fiber sources also have changed. Although cereals and bakery foods still are top sources of dietary fiber, soft drinks and dairy (two categories that lack naturally occurring fiber) also now are part of the larger discussion. That’s because their fiber content comes from added prebiotic-type fiber ingredients. All things considered, the dietary fiber landscape continues to change.

From Gourmet to Gut Health: Jeni Britton, founder of Jeni's Splendid Ice Creams, branched out with a second business, Floura, a “next gen fiber company.” Its high-fiber Fruit Crush Bar delivers 13g of fiber from 12 whole plants in every bite. Credit: Floura & Co.

Gut Health’s Link to Lifestyle, Trends

Innova Market Insights sees trend lines impacting better-for-you nutrition—involving fiber and gut health—on many levels. Economic uncertainty can be a stressor for consumers worried about the cost of living. Consumers tell Innova Market Insights that—after paying for essentials—health and wellbeing is their top spending priority.

Lifestyle and demographic factors also impact consumer thoughts and behaviors. For starters, there’s greater disease incidence and healthcare need with a large aging population and high levels of obesity. Meanwhile, there’s increasing pressure on healthcare systems with increased costs and reduced care access. Sometimes, consumers may feel inclined to seek their own wellbeing solutions—including products for digestive health.

A closer behavioral look shows consumers spending more time socializing and entertaining at home and this also impacts food choices. Consumers also tell Innova that they prefer small treats and moments of happiness as compared to “bigger experiences.” Here, food and beverage treats bring them that momentary joy. Healthy indulgences, including those that boost gut health, are essential.

Innova’s Top 10 Trends for 2025 include three trends that support a focus on digestive health and fiber. Our top trend, “Ingredients and Beyond,” emphasizes the relationship between ingredients and product quality. Fiber and prebiotic ingredients enhance product quality through their palpable gut health benefits.

The second trend, “Precision Wellness,” captures movement toward individualized, targeted nutrition solutions. Consumers personalize their diet planning and seek a personalized approach for improving the health of their gut. In response, processors can position their offerings for specific health needs, for example, gut health, as well as life stages and age demographics.

Innova’s fourth trend, “Gut Health: Flourish from Within,” demonstrates how consumer awareness of the microbiome is opening the door for fiber ingredients for digestive wellness.

Consumers of all ages worry about digestive health. In fact, nearly one-third of those surveyed say that digestive health is their main physical health concern. We observe that interest in products for gut health is higher among Gen X and Boomer consumers than among younger generations.

Purchase lags behind interest in targeted nutrition products for a physical condition like gut health, although products for digestive health are purchased more often than products for other health issues. Manufacturers may find a receptive audience among consumers who worry about gut health—but have not yet found products to relieve their symptoms.

Expanding Fiber Landscape

Fiber ingredients include those categorized as food-based fibers, soluble fibers, and prebiotic ingredients.

Food-based fibers are found in cell walls of grains and other carbohydrate foods. Benefits include laxation, support of healthy blood lipid and glucose levels, satiety, and immune system support. Soluble fiber has its own set of health benefits. Prebiotics are a subset of soluble fiber that cannot be digested by humans and are digested by microbiota to produce a health benefit.

We monitor new product innovation around a growing number of fiber ingredients, including chicory root fiber, inulin, oligofructose, fructooligosaccharides (FOS), galactooligosaccharides (GOS), human milk oligosaccharides (HMOs), polydextrose, soluble corn fiber, soluble tapioca fiber, resistant starch, and plant fibers. Inulin fiber ingredients are well-established. Fibers that are named for their source, such as chicory root fiber, citrus fiber, tapioca fiber, chickpea fiber, and others, can be positioned in a way that sounds natural and is easy for consumers to understand.

We see modest growth in food and beverage launches with fiber and prebiotics claims, along with solid growth in prebiotic ingredients. Categories propelling this growth include meat substitutes, cold beverages, and hot beverages with fiber claims.

The subset of HMO fiber ingredients demonstrates growth in infant formula and other baby products as manufacturers innovate to create baby milk and formula products that mimic the composition of human milk. As prebiotic fibers, HMOs can help improve gut health in infants. Parents may need guidance in choosing products for their young children, given the increase in number and variety of HMOs in infant products.

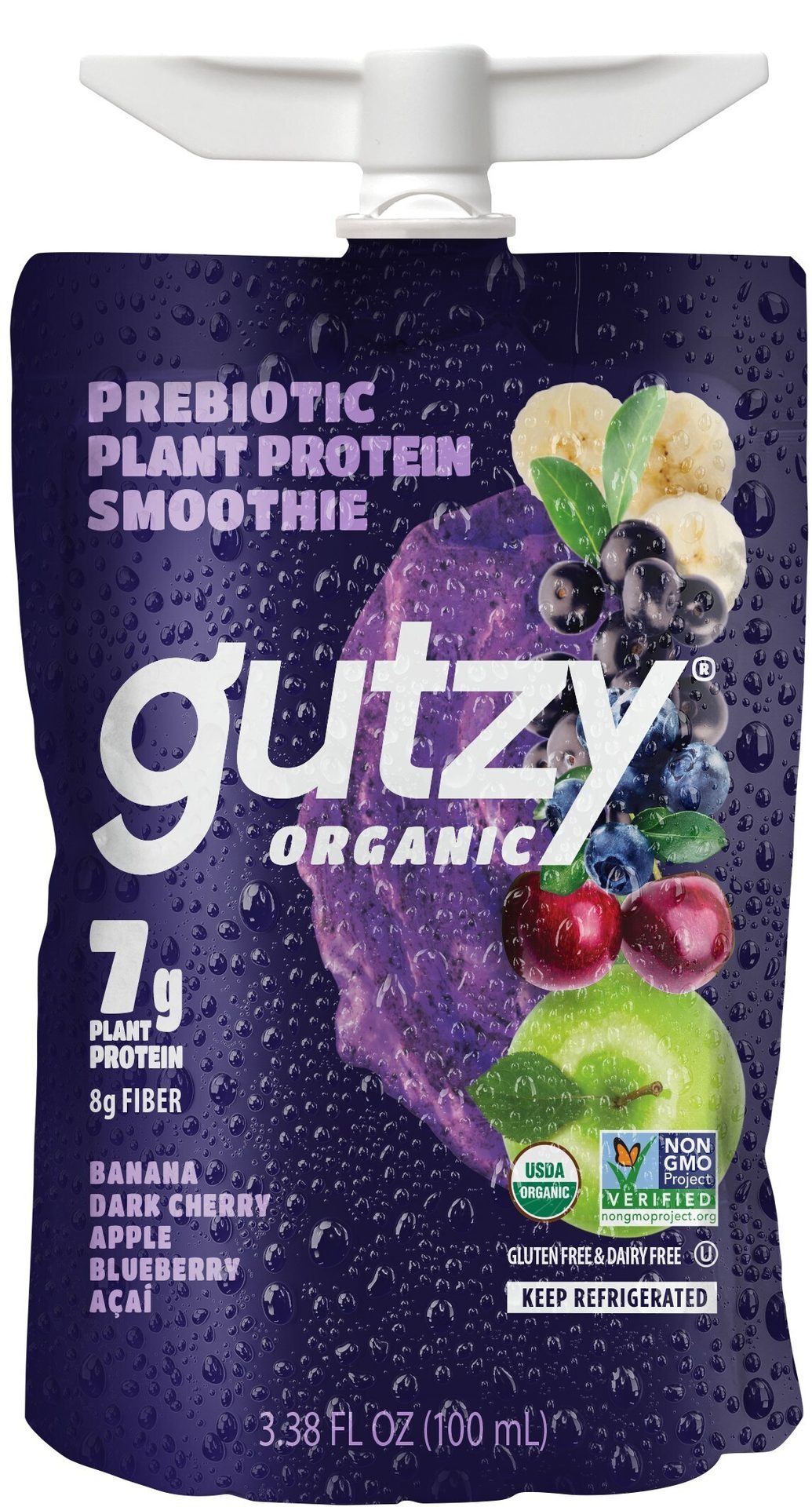

Quick and Convenient: With only one in 10 Americans meeting the recommended daily intake of fruits and vegetables, and 95% falling short on fiber, Keep Moving Inc. offers gutzy Organic Prebiotic Plant Protein Smoothie Pouches in the refrigerated produce section. Each 3.38 fl oz pouch contains 7g of plant protein and 7-8 g of fiber. Credit: Keep Moving Inc.

Tea it Up! Inspired by its co-founder’s personal journey with ulcerative colitis, Halfday delivers the RTD iced tea experience with a fraction of the sugar and a functional twist. Each can contains 6g of prebiotic fiber to support gut health. The company’s GOODDAY prebiotic blend includes cassava root fiber, fructan fiber, and organic agave inulin, making up 15-25% of daily fiber needs. Credit: Halfday Tonics Inc.

Prevalent Health Claims

Digestive and gut health has a solid presence in food and beverage launches. “High in/source of” fiber is the second leading functional health claim on food and beverage launches—topped only by protein claims. Post-pandemic, there’s been increasing consumer interest in gut health and fiber is a key product feature.

Gluten-free and vegan claims often appear on products with a fiber-related claim or ingredient. Overall, Innova doesn’t see as many claims involving prebiotic fiber. These claims are less well established and also may not be permitted in many countries. Product launch data show that fiber, vitamin D, and probiotic bacterial strains are the leading ingredients associated with digestive health product claims.

Gut health is linked to other aspects of health and healthy aging. Bone health claims and immune health claims show strong growth in product launches with a related gut health claim. Meanwhile, growing use of GLP-1 weight loss drugs has become another factor pushing fiber and gut health. These medications have increased and could continue to heighten consumer interest in products with fiber and protein for health, gut health, and satiety. We expect to see increased innovation around and sales of products with fiber for the GLP-1 user.

Better—by the Bowl: New premium cereal delivers muscle-supporting protein and gut-friendly fiber. Credit: Legion Athletics Inc.

Category Product Innovation

“Gut health” innovations pop up across traditional categories such as bakery, cereals, and cereal bars. Not surprisingly, these products routinely feature fiber-rich, whole grain ingredients.

Meanwhile, fiber claims and ingredients are becoming more prevalent for in other non-traditional categories such as sweet biscuits and cookies, energy bars, and even coffee. Meat substitutes often carry fiber claims related to vegetable fibers used for texture.

New carbonates positioned for gut health are driving growth with their prebiotic ingredients, which are well-suited for addition to beverages. Even new desserts with fiber ingredients align with healthy indulgence trends.

Worth the Weight: New BOOST Advanced Nutritional Shake supports nutritional needs during a weight management journey for adults on GLP-1 medications. Each serving provides 35g of protein to support muscle health, 4g of prebiotic fiber for digestive health and eight essential B-vitamins for energy metabolism. Credit: Nestlé HealthCare Nutrition, Inc.

Opportunities and Challenges

There are plenty of product innovation opportunities in the fast-moving marketplace for fiber and gut health. Consumers want to reduce consumption of ultra-processed foods and—when you consider bans on certain food additives—it’s more likely these same consumers will gravitate to products with naturally sourced ingredients such as fiber and prebiotic fiber.

Political and economic stresses in today’s world highlight the importance of maintaining personal health and resiliency. Consumers may feel stress first in the gut, so products positioned for gut health could be highly appealing to these consumers. Gut health—paired with energy, mental acuity, sleep, immunity, sexual health, and other desirable benefits—could catch the eye of the health-minded consumer.

GLP-1 users comprise a ready audience for fiber for nutrition, and to help overcome the gut discomfort that is associated with these weight loss medications. Also, in this era of economic uncertainty, an attractive price point for gut health products could attract consumers since inflation and financial pressures are likely to increase consumer stress around spending.

Reach out to Millennials, who have the highest level of interest in health among generations. They may respond to personal solutions and products for gut health. It may be possible to build lasting brand loyalty by providing Millennials with effective and lasting digestive health solutions.

Challenges exist. Crowding in the marketplace, especially in beverages with prebiotics, can confuse consumers by offering too many choices of drinks with similar benefits and ingredients. Consumers who incorporate too many of fiber- and prebiotic-enriched products into their diet may experience gut discomfort.

Again, education is important. Budget-conscious consumers may refrain from purchasing products that don’t deliver solid benefits. Consumers might not intuitively associate fiber with some new fiber-supplemented categories—including meat substitutes, confectionery, and desserts. As a result, more consumer education is needed.

What’s Next?

Innova predicts several trends involving fiber and gut health. We expect to see fewer prebiotic carbonated beverage choices with some degree of contraction in that market. Conversely, we predict increased use of resistant starch as a fiber source and continued growth of prebiotic ingredients over traditional fiber sources.

Overall, we expect more growth opportunities for products with multiple health benefits. Moreover, we foresee more products with protein and fiber to support weight management. In conjunction, there’s an opportunity for greater consumer education to make product selection easier to match health needs.

Lu Ann Williams is Global Insights Director at Innova Market Insights, provider of market research services including the Innova Database. With more than 25 years’ experience in the food industry, Lu Ann is a trend expert and frequent public speaker at events worldwide. She leads a team of analysts and works with global clients. Contact her at luann.williams@innovami.com