2022

Predictions

CANNABIS

The U.S. legal cannabis market experienced a breakout year in 2021 and BDSA expects U.S. legal cannabis sales will reach a whopping $25 billion, representing a 40% increase over 2020.

But it won’t stop there, next year BDSA expects the US legal cannabis market to reach nearly $30 billion in sales. Moreover, the US stands to be the driving force behind legal cannabis sales worldwide during the next five years.

US growth is being driven by key factors across states and stages of legalization. Mature cannabis states such as California, Oregon, and Colorado continue to see massive growth. New legal cannabis states such as Illinois, Massachusetts, Michigan—as well as new medical markets—are developing at an increasing rate. Emerging legal cannabis states, such as New York, are expected to yield huge contributions to BDSA’s forecasted market growth, all the way out to 2026

BDSA expects the US legal cannabis market to reach nearly $30 billion in sales in 2022.

High Growth Market

Photo courtesy of: Getty Images / panida-wijitpanya

What does BDSA suggest you keep an eye on in 2022? Here are some thought starters to ponder.

1. Classification (ie, Indica, Sativa, Hybrid) will fade away as a designation. Minors, cannabinoid ratios, and terpene driven benefits are the way of the future.

Since the early era of medical cannabis, cannabis products, especially flower, have been marketed by strain names, or indica/sativa/hybrid labels. While this dynamic of strain and indica/sativa characteristic labeling remains popular, these labels fall short of giving consumers an accurate description of the effects of cannabis products.

Going forward, we expect minors, cannabinoid ratios, terpene profiles, and beyond to replace strain and indica/sativa labeling. A host of new products have already begun to see success in mature markets. For example, in the edible category with the rise of CBN-infused products targeted as sleep aids, CBD products targeted towards consumer seeking anxiety relief and relaxation, and other less common cannabinoids such as CBG and THCv working their way into the product mix.

What’s in a Name? Branding is important and mergers and acquisitions will increase. This October saw Canada’s Canopy Growth Corp. agree to purchase Wana Brands, North America’s leading cannabis edibles business by market share. Photo courtesy of: Wana Brands

In BDSA’s Retail Sales Tracking in California, the top 20 gummy edible products in Q3 2021 featured 10 products infused with CBD and other lesser-known cannabinoids (also known as minors), a significant rise since Q3 2019, when only four products of the top 20 had lesser-known cannabinoids.

Unlike the indica-sativa-hybrid classification, which was straight-forward enough to gain relative uniformity among brands and manufacturers early-on, what has yet to be determined with functional benefit descriptions is what and how do we reach a new “standard.” The indica-sativa-hybrid classification and strain names have been useful in giving consumers a general idea of product effects, but are less useful than terpene profiles at giving a consistent description of the experience a product offers.

Right now, education and knowledge around terpenes are still in their infancy for the masses. BDSA is tracking only about 15% of cannabis consumers preferring inhalables claiming that terpene profiles drive their purchasing. However, BDSA is placing bets on terpenes becoming part of the vocabulary for cannabis consumers of all stages of experience in 2022.

2. Brand Recognition will Grow (AND dare we say brand loyalty will emerge?)

Consumers still do not name “reputation of a brand” as a top-10 influencer of their purchasing decision. However BDSA’s Consumer Insights tracks about 20% of cannabis consumers saying brand reputation influences their product choice.

Branding is still primarily a communication tool to link to a good product experience. Consumers are more likely to choose a product that is familiar, a brand they have used before (25%) or one that has been recommended by a friend or family member (20%). As brands continue to drive consistent, expected experiences and cross borders, greater recognition and loyalty will emerge.

3. More Blatant Quality Cues Will Drive Greater Pricing Differentiation

As the biggest brands continue to expand their product lines, price differentiation—driven by product features, benefits, technology/innovation, and quality—will emerge in a bigger way.

In California, for example, Live Resin is broadly accepted as having a higher quality than other vape cartridge-extraction methods. As such, BDSA is tracking Live Resin carts to represent more than one-third of total vape sales in the state (up from 8% in 2019). These products also make up over three-quarters of the top priced items in the category.

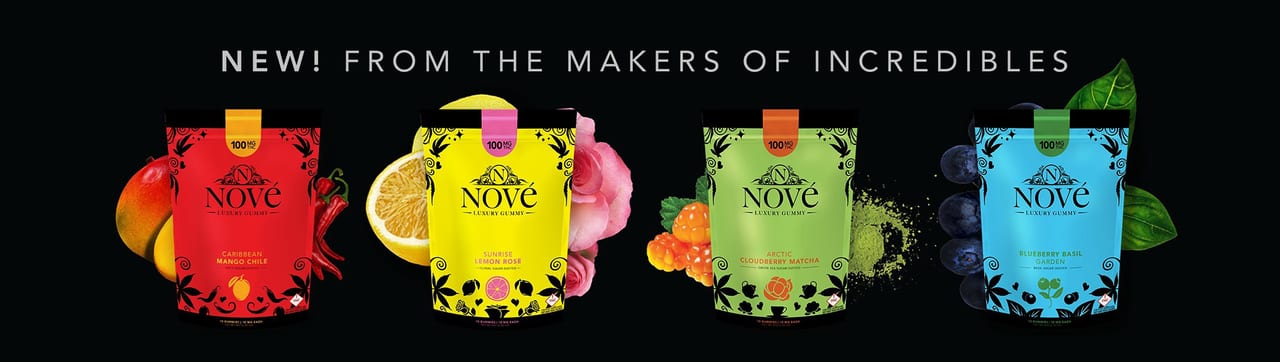

Further, consumers of edibles are willing to pay a premium for unique additional ingredients in gummies. Gummies that also contain CBD are, on average, priced about 20% higher and their sales have increased 40% between the second quarters of 2020 and 2021. Taking that further, the addition of CBN and CBG enables pricing up to 20-25% higher in the California market.

4. The Race for Global Cannabis Dominance is Underway but Traditional CPG Will Not Lead the Way

With more countries across the globe re-evaluating their stance on cannabinoid-based products each year and many now supporting burgeoning medicinal marketplaces (Europe, South America, and Africa), the rise of the global cannabis brand is here.

For example, Canadian-LP Tilray says it offers branded medical cannabis in 20 different countries around the world. And over the course of this year, we’ve seen competition for access to these emerging markets heat up with Curaleaf moving into Germany, Aurora acquiring a large equity stake in Netherlands-based Growery B.V., and Canopy Growth Corp. now holding distribution and production licenses in a dozen countries.

Where the Action Is: Kill Cliff (energy brand) and Jones Soda are among those exploring cannabis beverages. Yet BDSA anticipates mainstream CPG manufacturers and retailers will remain on the sidelines until the US has implemented federal legalization or de-scheduling that would ensure their “core” businesses are protected. Photo courtesy of: Kill Cliff LLC

Prediction: Edibles consumers will pay a premium for unique additional ingredients in gummies. This October saw Medically Correct (MC Brands LLC), Denver, launch a luxury edibles brand, Nové, with four varieties. They are Caribbean Mango Chile, Sunrise Lemon Rose, Arctic Cloudberry Matcha and Blueberry Basil Garden. Each gummy contains 10 mg of THC. Photo courtesy of: MC Brands LLC

But it is not just Canadian LPs looking outward, we’ve also seen US-based brands moving up north via partnerships and licensing agreements with Canadian LPs. For example, Wana, the leading Colorado-based gummy manufacturer entered into Canada via Indiva, and quickly took over as the #1 gummy brand in Canada.

Many (including BDSA) predicted more large CPG companies would have already moved into the global cannabis marketplace, but we are still tracking a “wait and see” approach by many of them. Obviously, exceptions exist such as: Constellation Brands and Canopy Growth Corp (with stake in Acreage and Wana), Altria and Cronos Group (who then has a stake in PharmaCann), British American Tobacco and Organigram, Molson Coors and HEXO with Truss, Boston Beer partnering to release cannabis beverages in Canada, and beyond.

We largely anticipate mainstream CPG manufacturers and retailers to remain on the sidelines until the US has implemented federal legalization or de-scheduling that would ensure their “core” businesses are protected and key barriers like restricted access to banking, lack of interstate commerce, and unfavorable tax provisions like 280-E lifted.

Although there’s plenty of rationale in their decision, the quagmire most will face in the future should they want to enter the space is whether to build from the ground up or buy an existing player. Both of these options are becoming increasingly more expensive as the leading cannabis brands continue on an exhaustive path of M&A, growing ever bigger and garnering higher valuations.

5. The FDA will continue to limit the potential of the mainstream CBD market (indefinitely?)

After the Farm Bill opened the floodgates for commercial hemp production, many (including BDSA) assumed a relatively quick FDA ruling that would allow edible products containing hemp-derived CBD.

As the months turned to years, non-edible CBD products, especially pet products, have done fairly well—but edible products have remained off the table for major brands and mainstream retailers.

As legal cannabis continues to spread, the general market appeal of other “light” cannabinoid products will wane. CBD topicals, pet products, and similar may continue to move through general retail, but the FDA’s lack of action will keep the legal cannabis channel (i.e., dispensaries) the sole platform for CBD-infused edible products—and it will always hold distinction as the source of products that provide an entourage effect.

BDSA’s current CBD market forecast (inclusive of both hemp and marijuana derived CBD) assumed grocery, drug, and other mainstream retail channels would see an influx of hemp-CBD-bearing edible products in 2022, taking general retail share of an anticipated $10B CBD market to 70% (versus 17% dispensary and 12% pharmaceutical). Without an FDA ruling, e-commerce is likely the only traditional retail channel to see much CBD sales growth in 2022.

Likewise, the spread of legal cannabis and further regulations will serve to dint the current strong appeal of quasi-legal cannabis products such as Delta-8, which already face existential regulatory/judicial challenges. PF

BDSA, Boulder, Colo., helps businesses improve revenues, reduce innovation risk, and prioritize market expansion with accurate and actionable cannabis market intelligence and consumer research. Visit www.bdsa.com to learn more.

December 2021